With the rising energy prices in 2022 we decided to look at fitting solar panels to our home, it’s fair to say we’ve learnt a lot along the way both in terms of planning the system, using it and things you’re often not told or explained; I’ll try and break down our experience here so you can make up your own mind if it’s actually worth it.

It’s not going to make millions!

Honestly, this is true for a domestic system, you will not make a heap of cash – absolutely no way. So if you think that fitting solar panels to your roof will mean it rains cash every time the sun comes out then stop reading now, it’s not going to happen. It’s true on systems fitted more than 5 years ago some households made money from relatively small investments but this was through the Government’s Feed in Tariff which guaranteed a rate of payback for every unit of electricity you generated, that scheme closed a few years ago.

If you’re a business considering solar (or any other self-generation) then you’ll still have similar thoughts and reasons for and against, just like a domestic system. The biggest difference will be getting someone to purchase your excess generation, known as export, for a decent price.

First, do your homework

Depending on where you live you may need planning permission and if your installation is above your current roof then it’s likely you will need planning permission, very important if you are fitting to a flat roof. Check this first as in some areas, for instance National Parks, the authorities may be very strict about the type and size of your panels and associated equipment.

The area for your panels should be in good condition both on and under the tiles. The panels themselves are fairly light but all the fixtures and fittings will add extra weight, high winds will also be a factor once they’re fitted so it’s worth checking to ensure your roof is structurally sound before you start as this will be an extra cost you may need to factor in.

You’ll also need some wall space and depending on the system this will be inside or out, all solar panels need an inverter which is a piece of kit that converts the DC electricity generated by the panels to that something that can feed into your home (and the grid). You might need quite a big area too as ventilation is important and not all kit can be fitted in the roof space so consider space in a garage or outside too. Some very recent consultations and guidance has effectively banned battery packs being installed in a roof space too.

Although you won’t need daily access to the equipment, you will need to be able to access all the components easily. Like any technology, you’ll sometimes need to reset it or even turn it off completely should you need to.

What are you trying to achieve?

Planning this properly will save you heartache in the long run but one key point is that it’s highly unlikely that you can be truly ‘off-grid’ once you flick that switch!

For us it was reducing our carbon footprint – In the last year we’ve offset 1.16tonne of CO2 by generating almost 5MWh of energy ourselves from 17 PV Panels.

Save money – By generating your own electricity you will instantly save money on purchasing electricity from your supplier, as you’ll be using your ‘free leccy’ from the sun but if you add battery storage your saving potential will double. If you generate too much solar for you to use now it can be stored for use later in a battery. On Winter days where generation is poor you can also charge from the grid during off peak hours and use this electricity during the day and evening when rates are higher.

Sell electricity to the grid – You can sell your electricity to the grid. Known as ‘exporting’, you’ll be paid for every unit you generate and in some cases you may be paid a premium to supply power at times of peak demand but generally prices paid are in the pennies not the pounds! I’ll cover whether you need to declare this income to HMRC later on.

Grid independence – This is very unlikely as you’ll have times of your own high demand where the grid effectively ‘tops up’ your power or simply where you haven’t generated enough to see you through the darkness, this is true during the Winter months. Some systems do have an emergency power supply capability but a little more on that later.

How do I pick an installer?

I found this really hard and took quite a few months of calls, emails and site visits but here is my experience and it wasn’t easy.

Clearly the first thing we all do is search online and that is exactly what I did, find a list of companies and contact them and I have to say it was painful! In my first search I found a couple of websites that would find installers based on your requirements and pass your details on to at least 3 of them so that was my first try.

The first call back I had was from an installer wanting to sell a standard system (as I know now there is no standard system) but as soon as they saw the house on Google Maps they didn’t want to know, as I found out later being mid-terrace is a bit of a pain!

A few more calls later and I worked out that it’s like trying to buy double glazing in the 90’s with everything from ‘our salesperson will visit and want to sit down with you and Mrs H’ to ‘we have special offers on our show home packages’. One chap was particularly upset when I asked if he would send details in an email to confirm the conversation he called me words to the effect of a time waster. Oh, the one quote I did get back from a virtual appointment was a 4-line email with a price and some basic system specs – that was a non-starter straight away.

At the same time, I had also put a message on our local Facebook group asking locals for recommendations on firms they had used, and after a few days I had a few different replies so started to contact them. One firm had stopped fitting in the area as they were too busy and I had two others call me back and arrange a site visit, hurray!

So, I pretty much have it down to the two companies I might use as both came with good recommendations. One chap came with his notepad, tape measure and ladders to have a look around but was very hesitant about the roof as it’s 45 degrees but he took measurements, looked at the consumer unit, wrote some stuff down and said he’d come back to me but he never did and never answered the phone either.

The other local firm (The Greenway Solar) sent a young lady out to measure up, take some photos of various things – consumer unit, meter cupboard, inside the loft, front and rear of the property and spent a bit of time asking what I wanted. Later that day I received a few brochures by email and a few days later very comprehensive quote by email, after some initial changes to our specs we received our quote and an estimate on delivery dates.

Fitting it all in.

The kit is delivered, scaffolding is up and contractors arrived it’s all go. Unfortunately, we had an unexpected Bank Holiday in the middle of our works so things slowed down a little but the roofing team turned up and placed panels front and back – we face East and West so covered both sides. First problem we hit was that our rear panels couldn’t be placed in the planned location due to some missing roof supports so a last minute change was made. It would have been better in hind sight to have less panels on the rear but I suspect the cost saving is minimal in reality.

After a few days the electricians arrived to fit the inverter, battery and associated equipment and quickly realised that this was not an easy job, our consumer unit is on one side of the house but the solar equipment was on the other with no easy route around. With plenty of drilling, pushing and pulling of cables (and lots of tea) the job was done – although we did have a fault with one set of panels which meant a return visit was required from the roofing team to fix and the system couldn’t be fully commissioned.

Again a few days went by and the roof team was back to fix the fault – simply a plug between panels was not attached. System up and running and generating super free electricity all we needed now was some sun.

The last piece of work was the bird proofing, I have to own up and say I thought this was just a way of getting more money out of me but asking around it seems it’s a real problem. Apparently, pigeons love to nest under solar panels and I’m sure, like me, you’ve seen the mess pigeon poo makes. Putting a mesh skirt around the sides of the panels prevents the birds from finding a home underneath, the work took an afternoon to do and so far we’ve not had any problems.

Not the end of the story…

So everything is up and running, installer paid and documents supplied which is where you need to be sure you have got what you paid and have the right bits of paper.

Any grid connected system will send electricity to the grid if you’re not able to use everything being produced, for instance when it’s very sunny or your unable to store it (or a mix of both) however without an export tariff from an energy supplier you’ll be doing it for free.

A number of suppliers offer a SEG tariff which basically pays a small amount for each unit of electricity you generate; a few suppliers also offer a non-SEG export rate and you may have to be a customer already but the idea is the same. However as part of this process you will usually supply a number of documents as proof that you generate you own electric and in our case it was the MCS certificate and electrical line diagram along with the DNO approval.

A couple of weeks went by and our energy supplier confirmed everything had been registered, smart meter updated and they were collecting meter readings and the next month we had a small credit on our bill from selling back electric.

Don’t forget you’ll also need the Part P Certificate proving the electrical work was carried properly and any other documents such as insurance certificates and invoice.

That’s it, all done. Just sit back and relax, well almost as there are some things you keep an eye on and like any new technology it can (and does) have the odd hiccup – a system restart will resolve most things and you have to be mindful of turning switches off in the right order should you ever need to isolate the power.

So what have we saved?

Through self-generation and being able to by electric at cheaper rates to use later in the day we’ve currently saved £435 in the first 3 months based on a standard tariff and used nearly 99% of all the electric generated ourselves with very little going back to the grid. We weren’t hit with the rise in energy prices as our utility company kept rates the same as until 2023 but the increase in prices means you can make more of a saving.

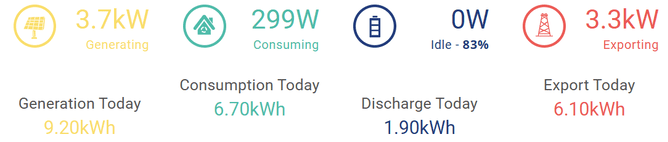

Now we’ve had the system coming up to 2 years, we’ve a lot more data to work with. We generated 4968kWh in the last year, which in money terms we’ve ‘saved’ around £1340. We sold just over £330 to the grid, mainly in the height of summer where we just can’t use it all ourselves. Big savings also come from the battery, which we use when there isn’t enough solar generation or at night. We also top this up with cheap electricity and in some cases have been paid to charge it up, we’ve also helped the grid over the winter as part of a virtual power plant by exporting electricity at times of high demand.

As for the return of investment, how do you actually work out what you save? I consider what we would have paid if we hadn’t gone down this route. Our home demand (excluding car charging) is around 4MWh per year and as rates have gone up and down I’ve estimated that we would have paid around £1160 for electricity. This gives us a ‘payback’ of just under 13 years with absolutely no changes, in reality that’s doesn’t happen. If we added in the money received for exporting the difference, the ROI comes down to 11 years.

But as we now have access to specialist electricity tariffs, the ROI gets far more complex to work out. We can shift our purchasing of electricity to cheaper times of day, which means in winter we purchase power off-peak to use later on. We’ve also exported power at times of high demand to support the national grid, this attracts an additional premium. Oddly enough, the opposite also happens where we’ve been paid to use electricity, so we charge the car and store it in the home battery. This bit is much harder to calculate but currently this brings down the ROI to 5.5 years.

All this does mean you have to do things a little differently though, alongside the usual turning lights off when you leave a room, you’ll also find putting washing machine on when the sun is shining becomes second nature but you might need to do this at night instead. We have some electric heating, so this has been timed to come on when more power is available and only when those rooms are likely to be used.

We also now have an electric vehicle and charge it either overnight on the cheaper rates or as part of the virtual power plant system. Although it’s possible to charge an EV from solar, it’s usually more cost effective to us the grid at cheaper times, it all depends on your tariff. Whatever your view on EV’s, for us it’s brought down the cost of car journeys down substantially. In March 2024, we were actually paid to use the car! Some windy weather conditions, combined with low demand meant our electricity purchase price went negative on some weekends.

Finally, things to note that you’re not always told.

You really do need a smart electric meter – solar will work without one but most energy companies will now only offer export tariffs to customers who have one fitted. If you’re thinking of a PV system then get this organised well before you have it fitted as it saves time (and money) later on.

You really need to make sure your installer is MCS Certified and completes all the required paperwork for you, ask them to submit the DNO application before they fit the kit and get the proof this has been done.

Get all the work done at the same time, there is currently 0% VAT on solar installations which includes battery storage too. You can now add battery storage separately but it has to be installed to qualify for 0% VAT, you can’t just buy from a wholesaler and add one yourself.

Systems will not work in a power cut, current regulations mean that the system will self-disconnect should the mains fail. With most systems you can opt to have an emergency power supply fitted, this can be as simple as a double socket or a complex changeover device however power loads are very limited and most properties (like ours) need separate protective earthing arrangements and the cost of works might be prohibitive.

Changing energy suppliers in the future can also be more awkward, you effectively have 2 supply points (import & export) and some automated systems pick the wrong one when you enter your address and just won’t give any quotes. We’ve even found some door to door salespeople have no idea about export tariffs and give incorrect advice. If you’re a business, this will add a whole extra complexity, but don’t let this put you off if the numbers add up.

Now for the tax bit, do I really need to pay tax?

We’ll split out domestic and business matters here. We’re talking about where the equipment is fitted, rather than it’s use. But, as always there will be some minor exceptions such as farm houses or mixed use premises.

Domestic premises, generally considered a home, whose energy supply is being classed as a domestic profile. The system is installed at or near domestic premises occupied by the individual will not be liable for income tax under a specific exemption in S782A Income Tax (Trading and Other Income) Act 2005. There is an note that suggests ‘the individual intends that the amount of electricity generated by the microgeneration system will not significantly exceed the amount of electricity consumed in those premises.’ There is no figure provided except a note of a ‘householder who does not intend to generate an amount of electricity more than 20% in excess of their own domestic needs’.

This exemption specially covers income from the sale of electricity generated by a microgeneration system, not the purchase, storage and subsequent sale of electricity, sometimes referred to as brown export. Neither does it include income from such schemes as the Demand Flexibility Service, which are payments for reducing demand or exporting power at times of high demand.

These such payments would be liable for taxation as personal income, as they are not from actual renewable generation but payment for doing or not doing something. It should be noted that these are payments over and above those received for simply exporting electricity.

Do you need to declare these payments? You should record them over the tax year and find the full value of your income. If the value is below £1000, it’s likely you can count this with your trading allowance. This covers such items as casual income & some small ‘table top’ type sales, you need to be aware that although you don’t need to declare this income, you should keep proof of why you don’t need to declare it.

Calculating such income can be difficult, but don’t forget that we’re talking about money you receive here, not points or bill credits. If you are in any doubt, especially if you’re receiving a lot of money from these schemes, you should seek professional advice.

For a business, all income received would count as business income and will be dealt with in the same way as any other income received. Where you have a larger multi-site business you may have access to tariffs to offset your excess generation at one site with the import at another, as this is effectively ‘offset’ then it doesn’t count as income.

You should speak to your business advisor or accountant prior to embarking on this type of capital project to see how the numbers stack up. Capital costs along with routine maintenance may be high and you’ll want to ensure that the project is going to make financial sense.